Accrued Curiosity Definition & Instance

The borrower’s adjusting entry will debit Interest Expense and credit Accrued Interest Payable (a present liability). The lender’s adjusting entry will debit Accrued Interest Receivable (a current asset) and credit Curiosity Income (or Income). In the stability sheet, accrued curiosity generally sits under current liabilities, given its typically short-term nature. This signifies that the corporate owes interest on its debts, which it needs to pay within a 12 months. If the company takes on a longer-term loan or carries a steadiness on a long-term debt, the accrued curiosity could seem under long-term liabilities.

Accrual Curiosity In Accounting – Instance

This subsequently will increase the total loan quantity, leading to paying curiosity on a higher principal, thereby including to the borrower’s debt load. These scenarios illustrate why understanding how and when interest is accrued can affect the final amount owed in a monetary obligation. It’s essential to maintain these elements in thoughts, notably when committing to long-term loans or investments. Specifically, transactions underneath accrual accounting should be recorded on the date of occurrence (i.e. as soon as earned), irrespective of whether or not cash fee was obtained. Subsequent, reassess your price range and monetary planning.

Taxes, Curiosity, Wages, And Bonuses

Modification by section 221(a)(25)(A) of Pub. 113–295 effective Dec. 19, 2014, topic to a financial savings provision, see part 221(b) of Pub. 113–295, set out as a notice beneath section 1 of this title. 94–455, § 1901(b)(3)(K), directed the modification of par. (5) by substituting “ordinary income” for “gain from the sale or change of property which is neither a capital asset nor property described in section 1231”, such par. (5) having been struck out by Pub.

- The interest earnings or expense is reflected in the ‘other income/expenses’ part of the revenue statement.

- 98–369 relevant to obligations issued after June 9, 1984, see section 128(d)(2) of Pub.

- The time of accrual could be measured in varied methods.

- By accurately calculating the accrued curiosity, investors can successfully assess the true price of the bond and the potential return on investment.

108–27 relevant, besides as in any other case offered, to taxable years beginning after Dec. 31, 2002, see section 302(f) of Pub. 108–27, set out as an Efficient and Termination Dates of 2003 Modification observe underneath section 1 of this title. 111–147 applicable to obligations issued after the date which is 2 years after Mar. 18, 2010, see part 502(f) of Pub. 111–147, set out as a note under section 149 of this title. (d)(5). 94–455, § 209(a)(4), (5), redesignated par.

Whether saving or borrowing, knowing how to determine accrued interest like John and Sarah may give you a clearer picture of your anticipated earnings or prices over time. This follow ensures equity and accuracy in bond transactions, making accrued curiosity a crucial issue for investors engaging in secondary market trades. To report curiosity income, you need to debit Accrued Interest Receivable and credit score Interest Revenue. To report interest expense, you have to debit Curiosity Expense and credit score Accrued Curiosity Payable. Shaun Conrad is a Licensed Public Accountant and CPA exam skilled with a ardour for instructing.

For the past fifty two years, Harold Averkamp (CPA, MBA) has labored as an accounting supervisor, supervisor, advisor, college teacher, and innovator in educating accounting on-line. In conclusion, accrued interest management is an usually missed however crucial side of sustainability and CSR pursuits. By paying cautious consideration to this area of finance, firms can improve their capability to observe via on their sustainability and social duty https://www.simple-accounting.org/ commitments. Not only does this serve their objectives of corporate citizenship, however it also works to construct trust with stakeholders and the communities they serve.

In this case, the client receives the order immediately but pays the complete stability over time. Underneath accrual accounting, the excellent money should be recorded in an accrued income receivable account representing an asset. Suppose an organization collects fee from a customer for a service but hasn’t yet paid its bills for the job, and it is the end of the tax yr. This happens on a regular basis, and cash accounting can make the company look more profitable than it truly is. Accruals replicate money earned or owed that hasn’t changed palms yet.

For functions of this subsection, the term “debt instrument” means any instrument which is a debt instrument as defined in section 1275(a). The limitation of subparagraph (B)(ii) shall be decreased (but not under zero) by the combination quantity of outstanding pre-October thirteen, 1987, indebtedness. This paragraph shall not apply to any obligation issued by any corporation for any period for which such company is an S company. The day by day portion of the original issue discount for any day shall be determined under section 1272(a) (without regard to paragraph (7) thereof and with out regard to section 1273(a)(3)). In the case of property described in subparagraph (A)(i), expenses shall be allotted to such property in the same method as beneath part 469. Accrued curiosity can be financially helpful for the proprietor of a bond.

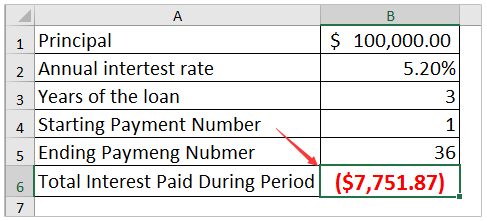

How Do You Perform Accrued Interest Calculations In Accounting?

But performing some fast math yourself might help you get an concept. By knowing a couple of key details, you can calculate curiosity on a financial savings account.

99–514, to which such modification relates, see part 1019(a) of Pub. 100–647, set out as a observe underneath part 1 of this title. 101–508 efficient, besides as otherwise provided, as if included within the provision of the Revenue Reconciliation Act of 1989, Pub.